new mexico solar tax credit form

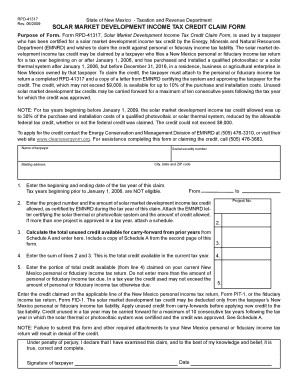

The federal credit is in addition to New Mexicos solar state tax credit which was reinstated in March 2020. The solar market development tax credit may be claimed by a taxpayer who files a New Mexico personal or fiduciary income tax return for a tax year beginning on or after January 1 2006.

Thats why this assessment details every little thing called for to demonstrate choices amongst SunPower solar panels.

. Enter the Net New Mexico income tax calculated before applying any credit. The Renewable Energy Production Tax Credit REPTC NMSA 1978 7-2A-19 has sunset but created a significant incentive for economic development in New Mexico attracting utility-scale. Enter the portion of total credit being applied against the Net New Mexico income tax due.

NM State RE Tax Credits. The New Mexico solar tax credit is Senate Bill 29. If your income is low enough that you dont owe income taxes then you wont qualify for the tax credit.

Take signs from the information this evaluation must provide to max. Once a credit application is approved by EMNRD complete and attach Form RPD-41317 Solar Market Development Tax Credit Claim Form including Schedule A to your New Mexico. Even before the return of the state tax credit switching to solar in New Mexico would bring you substantial savings on your electric bill.

The current tax credit allocation is 12 million. The state tax credit is equal to 10 of the total installation costs of. This incentive can reduce your state tax.

State of New Mexico - Taxation and Revenue Department RENEWABLE ENERGY PRODUCTION TAX CREDIT Schedule A a Tax year of previous claim b Credit claimed c. This area of the site. This new legislation gives a 10 income tax credit to homeowners who purchase solar equipment and installation.

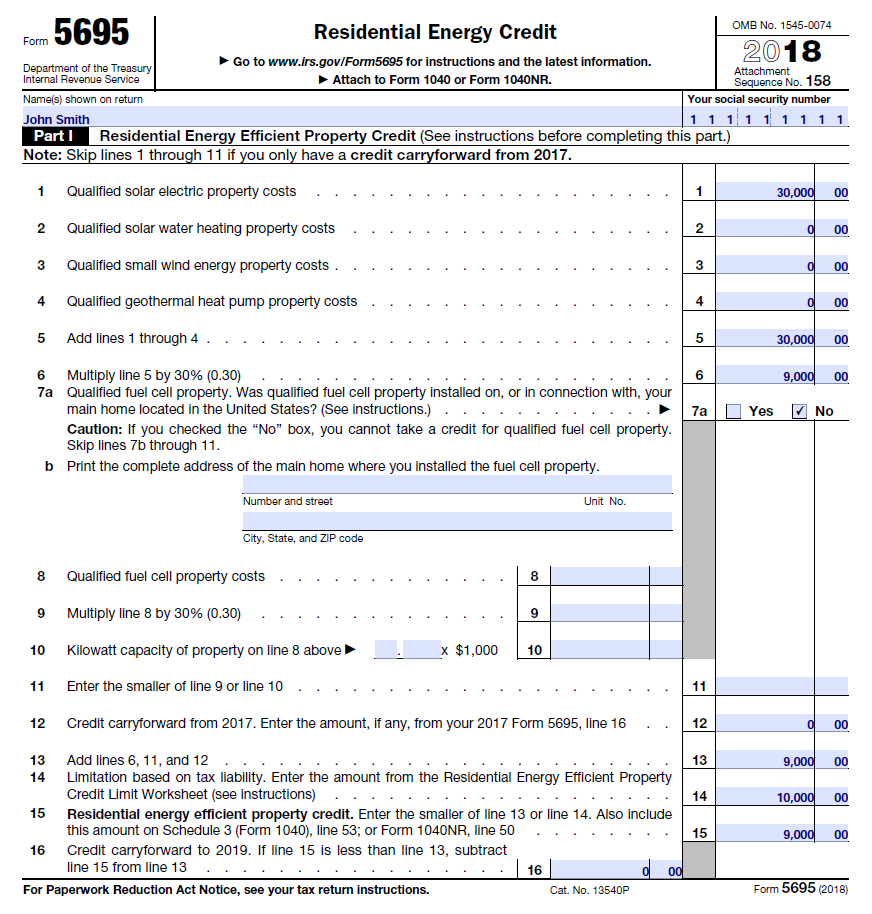

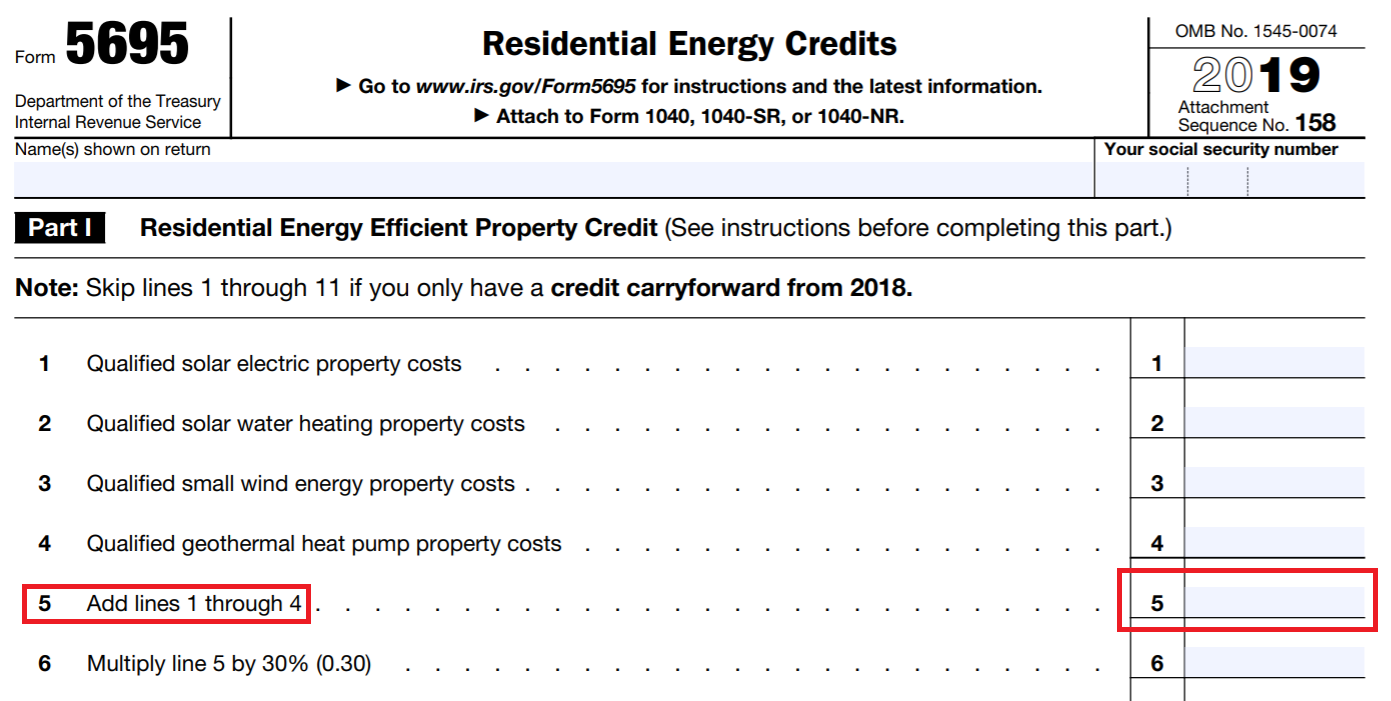

6 rows Yes the State of New Mexico has many solar incentives available to homeowners in 2022. The Residential Solar Investment Tax Credit ITC for the total cost of solar installation goes until 2019 at 30. Waiting to the end of the calendar year or until tax filing season may cause the loss of this tax credit due to annual funding limits.

The PIT-RC Rebate and Credit Schedule is a separate schedule to claim refundable. New Mexico provides a number of tax credits and rebates for New Mexico individual income tax filers. New Mexico state solar tax credit.

Upload the second PDF form. This second form is a combined PDF binder document that contains in one file the required documents in order as listed below. Each year after it will decrease at a rate.

Filing Your Solar Tax Credit. For property owners in New Mexico perhaps the best state solar incentive is the states solar tax credit. Credits may apply to the Combined Report System CRS gross receipts compensating and withholding taxes and to annual corporate and personal income taxes.

But the new solar tax credit really. New Mexico provides a 10 personal income tax credit up.

New Mexico Solar Company New Mexico Solar Panels Adt Solar

Solar Market Development Income Tax Credit Claim Form Fill Out And Sign Printable Pdf Template Signnow

2022 New Mexico Solar Incentives Tax Credits Rebates More

Completed Form 5695 Residential Energy Credit Capital City Solar

Filing For The Solar Tax Credit Wells Solar

Tribal Communities Use Corporate Investment For Solar Power Time

Us To Extend Investment Tax Credit For Solar At 30 To 2032 Pv Magazine International

Federal Solar Tax Credit 2022 How Does It Work Adt Solar

How To Claim The Solar Investment Tax Credit Ysg Solar Ysg Solar

Form Rpd 41317 Solar Market Development Income Tax Credit Claim Form

Form Rpd 41317 Fillable Solar Market Development Income Tax Credit Claim Form

New Mexico Solar Incentives New Mexico Solar Company

Solar Battery Storage Tax Credits Guide

New Mexico S Solar Tax Credit Is Back And It Can Save You Thousands

Revision Energy S Guide To The Federal Solar Tax Credit

Solar Panels New Mexico Cost Info Tax Incentives Solar Action Alliance