child tax credit 2022 calculator

1 day agoThe 2017 Tax Cuts and Jobs Act TCJA increased the maximum value of the credit to 2000 per child but limited the amount families could receive as a refund to 1400 per. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to.

Child Tax Credit For 2019 2020

Deadline to enroll for this benefit is.

. Required to file a traditional tax return. Our child tax credit calculator will help you estimate your refundable child. Your Adjusted Gross Income AGI determines how much you can.

Use the child and family benefits calculator to help plan your budget. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. There are seven federal income tax rates in 2023.

The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for qualifying children under the age of 6 and to 3000 per child. Then the taxpayer is required to pay the higher of the two. Calculate how much you can get.

11 hours agoChild Tax Credit Changes. The tax year 2023 maximum Earned Income Tax Credit amount is 7430 for qualifying taxpayers who have three or more qualifying children up from 6935 for tax year. Child Tax Credit 2021 vs 2022.

The IRS is no longer issuing these advance payments. Last updated April 05 2022. The Child and Dependent Care Tax Credit is worth anywhere from 20 to 35 of qualifying care expenses.

The Child Tax Credit part of the American Rescue Plan is here to help families raising children make ends meet. The amount is increased for children under. 150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower.

The credit is now available for children aged 18. Claim the Child Tax Credit in 2022 by e-filing your 2021 Tax Return on. The two most significant changes impact the.

You will get the additional one-time GST credit payment if you were entitled to receive the GST credit in October 2022. The maximum child tax credit amount will decrease in 2022. The following amounts are for the payment period from July 2022 to June 2023 and are.

Enhanced child tax credit. Estimate how much tax credit including Working Tax Credit and Child Tax Credit you could get every 4 weeks during this tax year 6 April 2021 to 5 April 2022. Big changes were made to the child tax credit for the 2021 tax year.

How much money you could be getting from child tax credit and stimulus payments. The child tax credit is now 3000 for children between the ages of 6 and 18. In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

The Child Tax Credit can significantly reduce your tax bill if you meet all seven requirements. Have been a US. Estimate Your 2021 Child Tax Credit Advance Payments.

Provide the following information and. Payments will be issued automatically starting November 4 2022. Updated for Tax Year 2021 October 3 2022 0242 PM.

112500 if you are. If your MAGI is over 75000 the. Partial Expanded Child Tax Credit.

For children aged 6 to 17. The Child Tax Credit income limits are as follows. In 2022 US expats are eligible to receive between 1400 up to 3600 per qualifying child on their 2021 US Tax Return.

You can use this EIC Calculator to calculate your Earned Income Credit based on the number of qualifying children total earned income and filing status. By The Kiplinger Washington Editors. The 2021 credit increased to 3600 from 2000 in 2021 and you receive a credit for each child under six years of age.

Under the 2023 IRS tax inflation adjustments the AMT exemption amount begins at 81300 or 126500 for joint. In detail the latest child tax credit scheme allows each family to claim up to 3600 for every child below the age of 6 and up to 3000 for every child below the age of 18. Up to 3600 per child or up to 1800 per child if you received.

If your MAGI is 150000 or under you will receive 3600 per child under 6 and 3000 per child age 6-17.

Employee Retention Credit Erc Calculator Gusto

Tax Credit Definition Types How To Claim

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

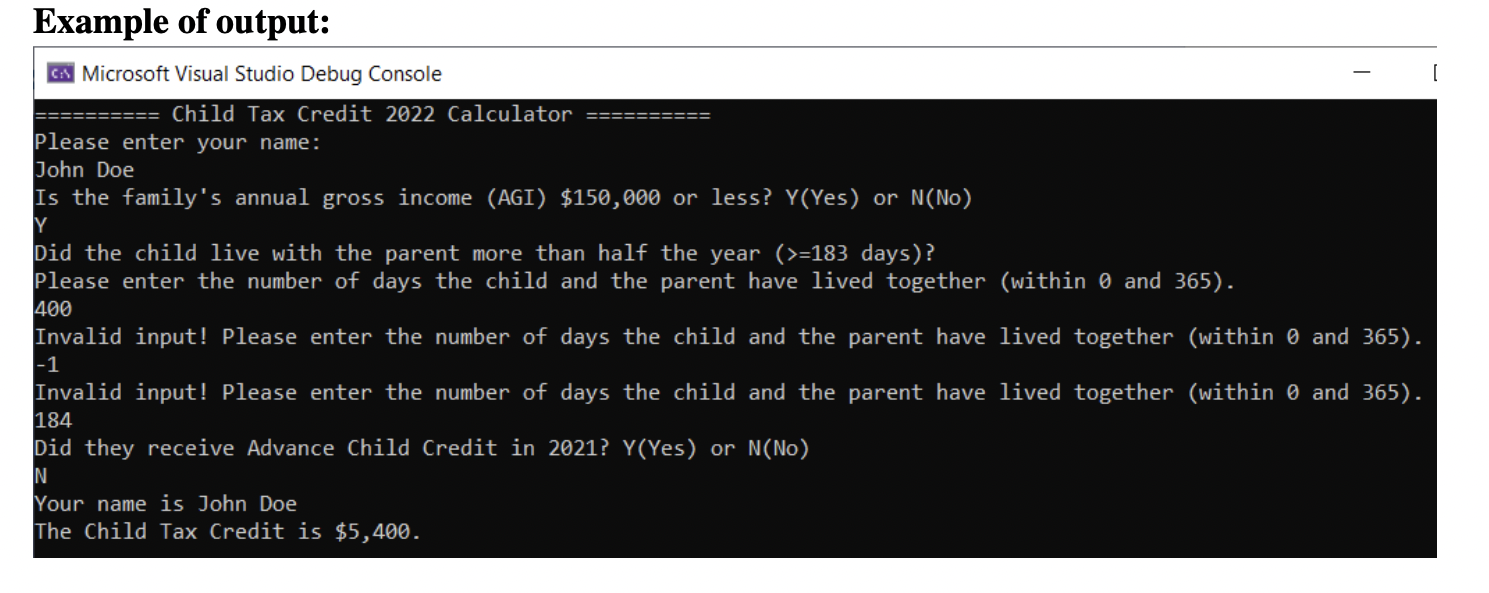

Solved Programming C Write A Program That Can Calculate Chegg Com

Health Insurance Marketplace Calculator Kff

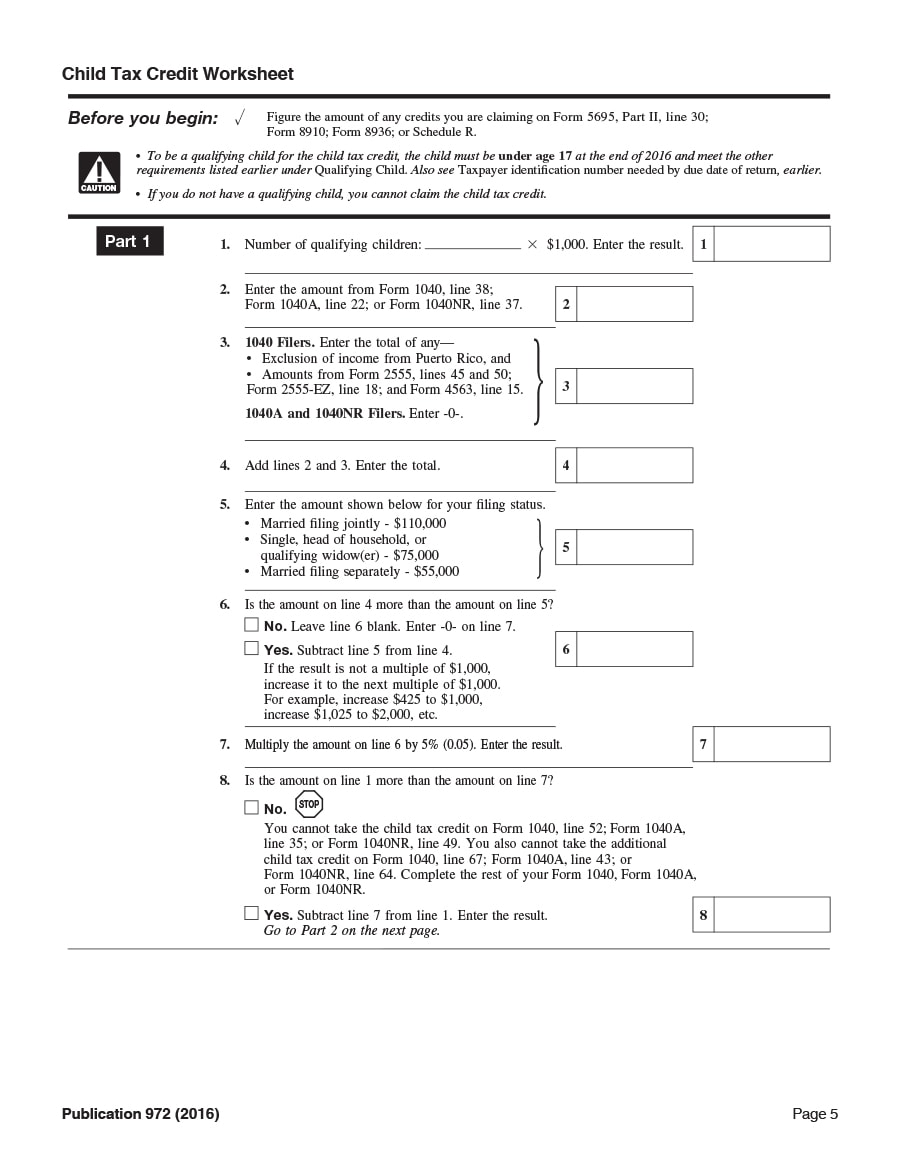

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Will I Receive The Child Tax Credit In 2022

Earned Income Tax Credit Calculator Taxact Blog

Try The Child Tax Credit Calculator For 2022 2023

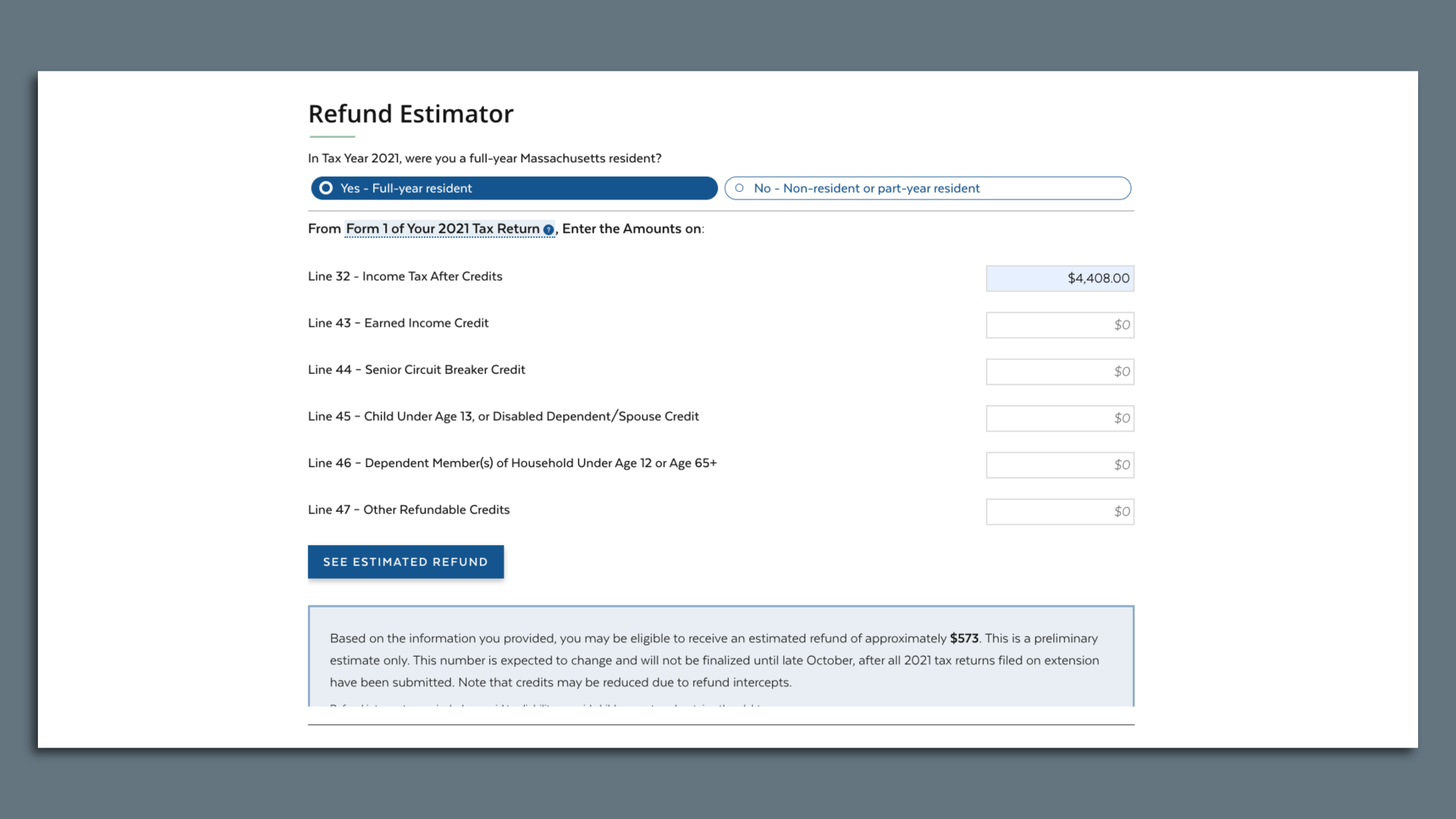

How To Calculate Your Projected Massachusetts Tax Rebate Axios Boston

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

2021 Taxes 8 Things You Need To Know About Ffccu

Child Tax Credit Here S What To Know For 2022 Bankrate

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

23 Latest Child Tax Credit Worksheets Calculators Froms

Download The Dwc Tax Credit Calculator

California S Earned Income Tax Credit Official Website Assemblymember Phil Ting Representing The 19th California Assembly District